Automation in the industry

Event at Komax Holding

On May 7, 2024, we were guests at Komax in Dierikon with interested investors. We have been investing in Swiss second-line stocks through our equity fund Reichmuth Pilatus since 1996. Komax has been listed on the Swiss stock exchange since 1997 and we bought Komax shares for the first time in January 1999.

This type of event gives our guests a direct insight into selected companies. Through personal contact, they can gain an impression of the company’s management and activities.

The Komax Group is the global market leader in automated wire processing. In addition to production systems, quality assurance, test equipment and networking solutions come from a single source. Changes in the labor market, changes in environmental awareness and the increasing complexity of end products and the resulting higher quality requirements are global megatrends that will contribute significantly to the steady increase in demand for automation solutions. This is because they are leading to more and new types of cables that require increasingly automated processing due to factors such as quality, efficiency, costs, miniaturization and traceability.

In his presentation, Matijas Meyer, the CEO of the company, explained to us the newly developed strategy and the long-term growth prospects of Komax. In order to achieve its goals, the Komax Group must grow faster than the market. To this end, four strategic directions were adopted:

- Generating added value along the customer journey

- Innovation for automation and quality

- Strengthening global customer proximity and

- the development of non-automotive markets, which already account for 25% of sales

The integration and scaling of the acquisition of former competitor Schleuniger and the digital transformation are two other key strategic initiatives that are important for achieving profitability targets and financing growth. In a second part, we were able to visit production, the vertical factory and the showroom. It was extremely exciting to see, for example, how a wiring harness for a car is produced and what it looks like in individual parts.

The production speed in combination with the high precision was very impressive. Thank you for the interesting insight!

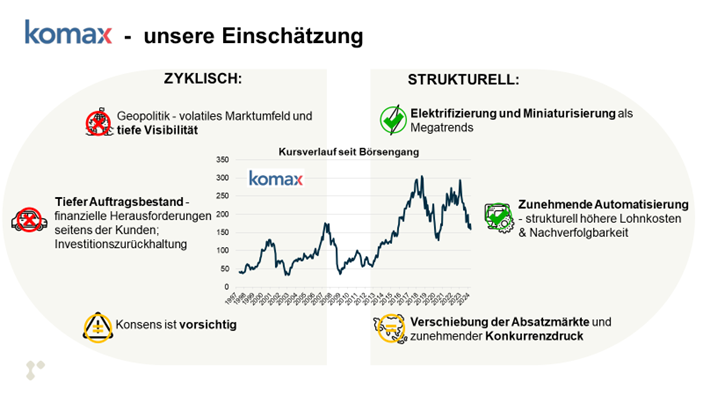

Our assessment: Komax operates in a very cyclical business. This is currently going badly, visibility and the order backlog are low and the analyst consensus is cautious. This is also reflected in the share price, which has almost halved from its highs. However, the structural medium-term growth trends such as electrification and miniaturization are intact. The shortage of skilled workers and structurally higher labor costs speak for increasing automation, and Komax is very well positioned in this respect. Today, for example, 80% of wire harnesses are still produced by hand. In the small cap segment, we prefer companies that are market leaders in their niches and are well managed. They should have a solid balance sheet, which helps in a cyclical low, and ideally have a long-term anchor shareholder. All of this applies to Komax and we would use the current share price weakness to gradually build up positions.