Energy – the topic of the decade

From the “Green Deal” vision to securing energy supplies

Europe wanted to become the first climate-neutral continent and achieve net-zero greenhouse emissions by 2050. The boot is now on the other foot, with energy security the dominant issue and likely to preoccupy politics and society for years to come.

Index weighting?

The demand for energy is growing, particularly in emerging economies. In the short to medium term, the focus is on access to fossil resources such as oil and gas; in the medium to longer term, it shifts to the expansion of renewable energies. This makes it all the more astonishing to see how much weight energy companies carry in the world stock market index today. A mere 4 %, which is in sharp contrast to the technology sector with its current weighting of 22 %. In retrospect, there were certain arguments that justified such a low weighting. Russia was considered by many to be a reliable energy supplier, investments were channelled primarily into other areas with higher growth rates, and as climate awareness increased, many institutional investors banished fossil fuel companies from their portfolios. As an active and forward-looking investor, the current low weighting for the next few years does not appear logical.

Direct equity investments

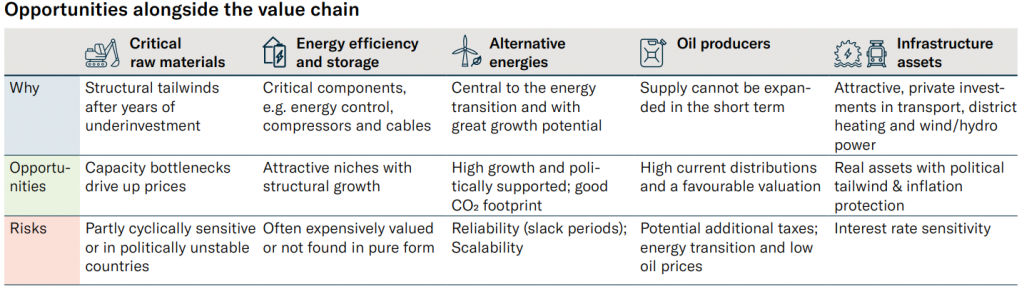

In addition to favourable valuations, we view the high regular distributions (dividends and share buyback programs) as one of the arguments in favour of listed energy companies, whose cash flows seem secure for the next few years since the supply can hardly be expanded at all. Alternatives such as nuclear energy are not (yet) politically acceptable, and other promising technologies lack the necessary maturity. In the medium to longer term, the major energy firms are also likely to emerge as dominant players in the renewable sector. Until then, we also recommend targeted investments in renewable energies. Suppliers are benefiting from full order books. Companies specialising in energy efficiency are likely to be in demand as well (e.g. building services engineering, heat pumps, climate control, etc.).

Financing the infrastructure

For long-term investors, we recommend an allocation of specialised infrastructure assets. Expanding and modernising infrastructure in the energy sector requires tremendous amounts of money that hardly any state can fund alone – making them dependent on external investors. In return, investors receive a long-term, contractually secured fee, which in many cases is also adjusted for inflation.

Regional and individual preferences

Access to energy is becoming more and more of a competitive factor. Europe will be at a clear disadvantage on this front over the next few years, and its high energy dependency could become a geographical disadvantage. Energy security will now become an important factor for regional asset allocation as well, and play a role extending beyond stock selection. Personal sustainability preferences are of special importance for investments in the energy sector, as you can set clear priorities when selecting stocks.

We are happy to customise our best investment ideas in

the energy sector to meet your individual needs.