From screw dealer to industry partner

Event at Bossard

On October 16, 2024, we had the pleasure of inviting interested guests to an investor event at Bossard in Zug. Bossard has been listed on the stock exchange since 1987 and has come a long way. Our Reichmuth Pilatus equity fund has been investing in Swiss second-line stocks for almost 30 years. We acquired our first position in Bossard shares in 1999 and have been following the company ever since.

The Bossard Group is one of the leading strategic partners for industrial fastening and assembly solutions for OEM customers (original equipment manufacturers) worldwide and has extensive expertise in the areas of engineering and logistics services. Starting out as a screw distributor, the company has developed steadily. They now have over 1 million different items in their range and have proven expertise in technical advice and stock management. They offer this expertise to their customers in order to optimize their processes, become more efficient and save costs. In the area of smart factory logistics, they evaluate their customers’ order data in order to network and streamline various processes in the manufacturing industry. They also offer solutions in the area of intelligent production facilities (Smart Factory Assembly). Assembly is digitized and thus networked with various systems, which offers real-time data collection, traceability and flexibility.

We were able to experience these two areas up close during a guided tour. We then visited the automated warehouse.

In his speech, Dr. Daniel Bossard, CEO of the Group, spoke about the Group’s growth opportunities. During his presentation, he introduced the new Strategy 200, which should be implemented by 2031, the company’s 200th anniversary. Bossard wants to double its annual growth from 3 % to 6 % with slightly increased profitability and gain market share by means of seven strategic initiatives. Dr. Daniel Bossard also shared his impressions and assessment of the industry with investors. The company has a global customer base that is diversified across sectors and has its finger on the pulse of the economy. The market is currently in a difficult environment, but according to him, opportunities should not be ignored. The supply chain problem started during the coronavirus pandemic. This prompted customers to stock up heavily. Then came the economic headwind in Europe. As a result, growth is still at a low level. Bossard is no stranger to a difficult environment. However, the duration of the now almost two-year phase of weakness in the industry is unprecedented in the last 25 years.

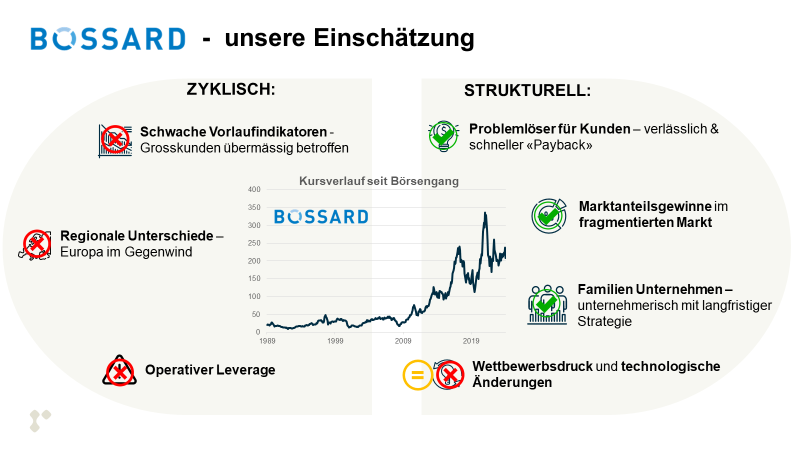

In our company analysis, we look on the one hand at cyclical indicators that influence the share price in the short term and on the other hand at structural indicators that are decisive for the long-term development of the company. The following chart shows our assessment.

The cyclical side has been dominated by the difficult environment in industry for two years. Leading indicators such as the purchasing managers’ index are only slowly improving. Unsurprisingly, Bossard’s short-term cyclical indicators are creating headwinds. Europe, an important sales market, is in a weak environment and incoming orders are at a low level. However, we consider Bossard’s structural, long-term drivers to be positive and are therefore optimistic that Bossard will receive a significant tailwind when the industry recovers. By evaluating its customers’ order and usage data, Bossard can identify potential for optimization. This leads to cost reductions and resource savings for their customers. With this offer, they can win over their customers in the long term. Bossard’s global market is very large and highly fragmented. This is a good environment for generating growth and added value through targeted acquisitions. With their innovative products and services, they have great potential to gain more market share. The company is also prudently managed and, with the family behind it, it has a long-term oriented main shareholder.

Finally, the interested investors were able to discuss with Dr. Daniel Bossard and Stephan Zehnder (CFO of Bossard) as well as the analysts and client managers of Reichmuth & Co Privatbankiers. During the aperitif riche, questions were frequently asked about the challenges of current market developments and future growth strategies.