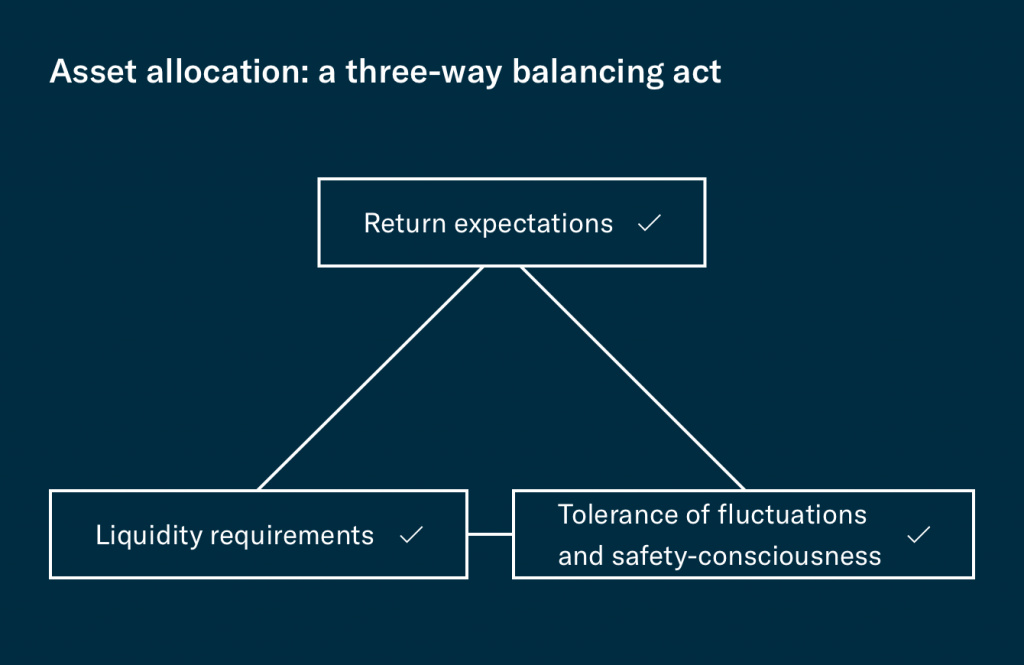

Investments for foundations – a three-way balancing act

A foundation’s ideal asset allocation depends heavily on where it is starting from and must be defined on a case-by-case basis. Foundations and their trustees are often caught between the competing demands of return expectations, liquidity requirements, tolerance of fluctuations in value and safety-consciousness. As a general principle,

- the higher the return expectations and the longer the investment horizon, the higher the allocation to equities. This is particularly true when investments are made in traditional asset classes such as equities and bonds, and assets such as infrastructure that generate strong cash flows are excluded.

- The greater the immediate need for liquidity for grant purposes relative to the investment income and incoming donations, the lower the risk capacity and the greater the weighting that should be given to safe, liquid assets.

- If a higher return is desired in the long term in order to better fulfil the foundation’s purpose, and if liquidity needs can be met through dividend stocks that generate strong cash flows, a high allocation to equities is appropriate, reflecting the maxim that time is an investor’s best friend. Investors must accept sizeable fluctuations in value along the way.

- If a low allocation to risk assets is primarily motivated by safety-consciousness on the part of the board of trustees, bringing in a specialist to provide education about investments can pay off.