Is your estate in order?

Customised wealth transfer to the next generation

Taking the initiative and being proactive in life comes naturally to us. The same should apply to your estate. If you do not arrange matters, the law will handle your estate, leading to results that often do not correspond to your wishes as the testator.

Smart estate planning

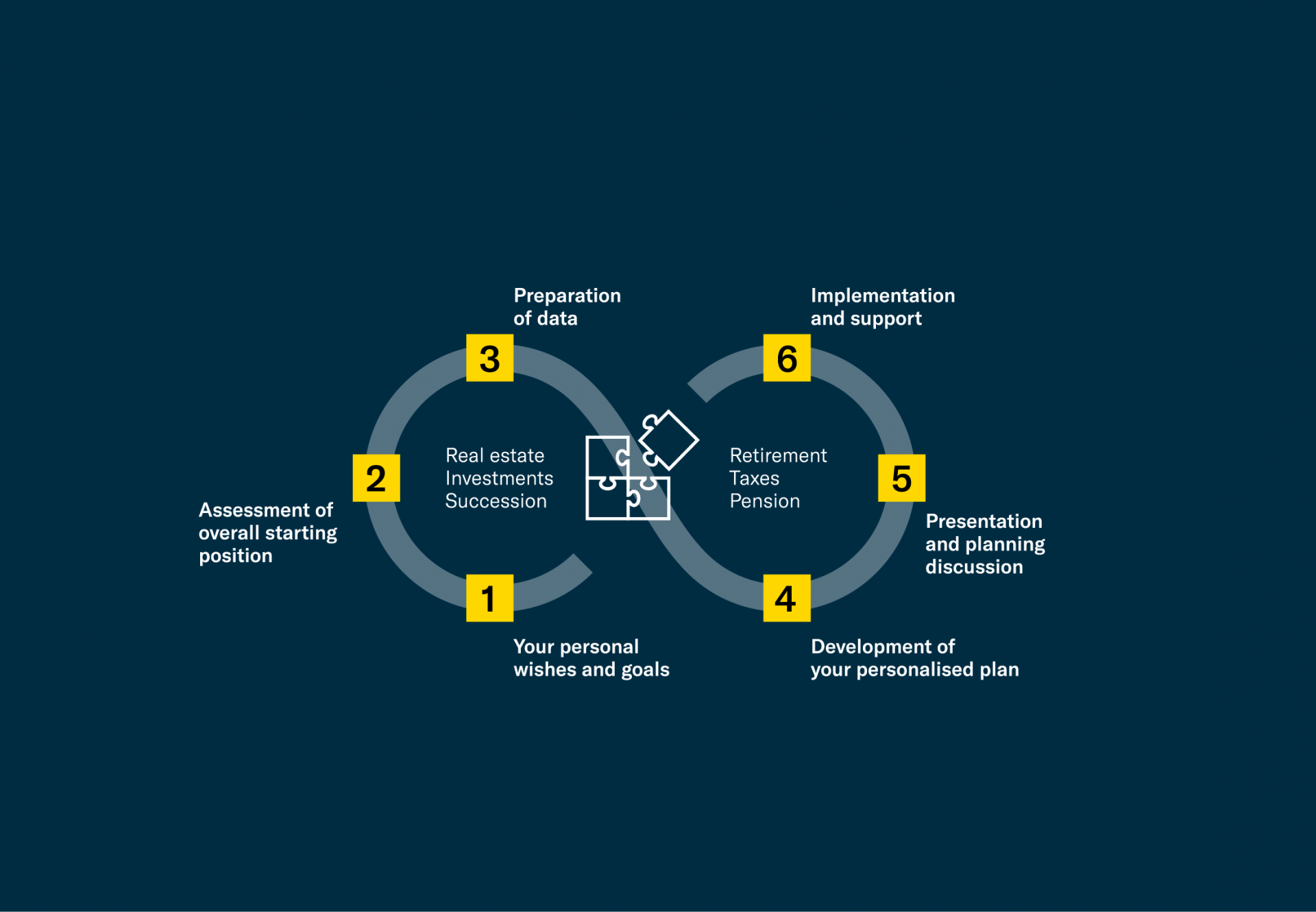

The new inheritance law from 1 January 2023 removes the compulsory portions of parents and reduces the compulsory portions of children. This increases the portion of your estate which you are free to dispose of as you please – but only if you are proactive in planning your estate. We provide our clients with expert support in transferring wealth to the next generation¹. Who should eventually inherit your assets? Do you want your spouse or partner to be financially secure? Should godchildren or charities benefit, for example? Who will continue to run your company? Are there any other important areas for you to consider? You outline your goals and we develop a customised concept that is tailored to your personal situation, your wishes, your asset structure and the regulatory framework conditions, incl. taxes. In the process, we design various scenarios and determine how assets should pass to the next generation depending on the scenario so you can achieve your targets. We do advise you on how to structure your assets and if you wish, remind you at regular intervals to review your arrangements.

Reviewing existing arrangements

Have you already arranged your estate (years ago)? As a general rule, it is recommended to review the estate deed every two to five years as well as when significant events occur – such as moving your residence, marriage, the birth of a child, divorce, inheritance, or retirement. Use this change in the law as an opportunity to revise your paperwork today. Many times, existing arrangements may be worded in a legally ambiguous way from a current perspective. It is frequently unclear whether the children should receive the compulsory portions under the old law or the lower compulsory portions under the new one, for example. These ambiguities can often lead to disputes in the event of a death, which then have to be clarified by the authorities. During a legal review of your inheritance contract or will, we determine whether your last will and testament is clearly formulated. If there are any ambiguities, we will find pragmatic solutions for you.

Lifetime transfer

Making a partial transfer of assets during your lifetime might be an astute move. The reasons for this depend on the individual case. Involving the next generation at an early stage can strengthen the family structure and be favourable from a tax perspective. If, for example, a property is passed on to a child, this often leads to (undesirable) unequal treatment between the children. With early consultation and careful planning, we can create transparency for you and your family and prevent disagreements between siblings.

Representation of heirs

Are you part of a community of heirs that has not yet been dissolved? This community of heirs is created by law after a death. Dissolving one – without executing a will or getting official involvement – requires expertise and can be time-consuming. We can advise your community of heirs as a representative of the heirs and draw up the estate division agreement on behalf of all heirs.

Execution of the will

If you wish, we can handle your estate as an independent executor. We will ensure that your estate passes to the next generation in accordance with your last will and testament. As an executor, we will administer the estate until it is divided, distribute legacies if necessary, and take care of administrative tasks. In the event of disagreements between heirs, we provide tactful mediation and reach a compromise solution.

Benefit from our expertise – we will be happy to advise you.

¹ We advise exclusively according to Swiss law and involve experts for special local or international issues.